Retirement Experts Network: Peter Neuwirth and Barry Sachs star on today’s webinar, “Rethinking What You Need to Thrive in Retirement”

July 19, 2022: Christian Mills is the host of today’s webinar at the University of Illinois Academy for Home Equity in Financial Planning. Don’t miss important insights from actuary and author Peter Neuwirth and retirement portfolio longevity expert Barry Sacks.

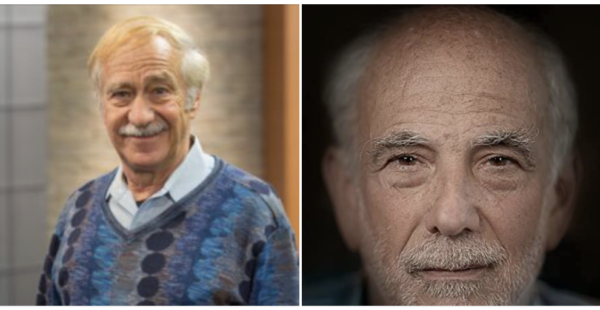

Meet Peter Neuwirth (pictured above, right): For the last 40 years, Pete has held actuary leadership positions at consulting firms, including Aon, Hewitt Associates, and Watson Wyatt Towers, and he also ran the actuarial firm, Coates Kenney. Pete is a fellow of the Society of Actuaries and the Conference of Consulting Actuaries. Pete’s a senior consulting actuary for CapAcuity, a member of the University of Illinois Academy for Home Equity in Financial Planning, and the outside director at Rael & Letson. He regularly consults with the largest corporations in the world about retirement plans with a focus on time, risk, and money.

Barry Sachs is a Ph.D., a JD, and a retirement portfolio longevity expert (pictured above, left). After spending 35 years as an ERISA attorney specializing in qualified retirement plans, he used his breadth of skills to discover how a reverse mortgage could help make a retirement portfolio last longer.

Barry now has a law practice providing special services to tax professionals in the area of offers in compromise for retirees living on 401k accounts or securities portfolios. With his brother Professor Steven Sacks, Barry published the pioneering research paper modeling reverse mortgage credit lines in the Journal of Financial Planning in February 2012. Barry is also a member of the University of Illinois Academy for Home Equity in Financial planning.

Peter Neuwirth: Well, thank you very much, Christian. And it’s great to be here. And we need to rethink what it takes to thrive in retirement because this is a new world with a very, very different environment than we’ve had for quite some time. I won’t say it’s unprecedented, but certainly not in the last 40 or 50 years have we been in this economic environment.

And there are many reasons we need to rethink how to get by and how to help people get by in retirement. So if we could flip to the agenda, next slide. So today, we’re going to talk about, well, the old model, which was a three-legged stool that many of you probably remember and how that model is now broken, and we are going to need to, we believe need to replace it with a new model. And that model entails more self-reliance and individuals taking care of themselves.

And so that’s why we say three tools for your backpack. And these are three tools you can acquire yourself and need to acquire yourself, although you’ll need help from an employer, the banks, an insurance company to do so, or folks like you in the audience. So we’ll talk about those three tools, and then we’ll try to put it all together in context because all of what retirement is a decumulation problem.

During your working career, or as you go through life, you’re accumulating assets, but in retirement, you need to decumulate them. And that is a difficult, challenging problem that hasn’t been solved yet, but we have some thoughts and an approach. So with that, let’s go to the next slide. Okay, so probably everybody or most people in the room have heard of the three-legged stool.

The idea of a three-legged stool was coined by an actuary working for the Met in 1949 and has received wisdom from retirement planners, actuaries, and others for decades.

And that three-legged stool, which theoretically was to provide the basis for a secure retirement, included social security provided by the government, a guaranteed pension. And this was a pension, not a 401k, but a guaranteed defined benefit pension as most employers had in the ’60s. After ERISA exploded, I think there were 20 some thousand defined benefit plans in 1975, and now there’s maybe 7,000 or so.

That third leg was personal savings. So those are the three legs that, for many, many years, advisors and employees relied on them once they retired. So let’s move to the next slide if we could. But a couple of those legs are now broken. For one thing, social security is there, but it may be creaky because the latest trustees report shows that by 2033 there will be no funds available, and all that will be relied on is the social security taxes to pay benefits. And that only covers about 75% of the benefits.

By law, what that means is that every social security recipient will have their benefit cut back by 25%. Now, one can hope that the government or Congress will do something to prevent that from happening. But if nothing is done and betting on no action is usually a pretty good bet when you’re talking about Congress, although in this case, I’m not sure that’s inevitable, that leg is going to be at least weaker if not broken.

The defined benefit leg, on the other hand, truly is gone for most people. At this point, I think only 26% of workers have a defined benefit plan. And so what that means is that the third leg really got too much to bear because people’s personal savings, while better than they used to be, are just not enough. So we can move on. Barry, you’re going to tell us about the new model you’re considering.

Barry Sacks: The new model is also a three-legged stool, but they’re quite different legs from what we were sitting on, resting on, or relying on the past. Now we have to look to home equity. That’s a particularly important feature because it turns out that most people have most of their wealth in their homes when they reach retirement age.

Not everybody owns a home by the time they reach retirement age, but it turns out that in this country, about 70%. So that’s most people by a two-to-one margin. And of those people, another 70% own the home outright by the time they reach retirement age. So that’s a real asset, and people have to begin to think; many have begun, but many more need to begin to think about drawing on the home equity in the form of a reverse mortgage as one of the legs for retirement stability.

Another item, of course, is insured products. Pete will go into it later in this presentation, insured products like homes can provide many different benefits for people. As time goes on, people go from being a young family when they need the protection of life insurance to be an older retirees where they no longer need the protection in the event of death, but they can draw on the cash value if they’ve gotten some cash or if they have some annuities along with it.

And then finally, the third tool is employer-provided retirement programs, which, as Pete pointed out, are now primarily defined contribution plans. In this case, the employer provides the plan, but very often, the employee provides the money. However, I should point out that sometimes the employer pays into those plans and sometimes they match what the employee pays into those plans. So these are factors that should be considered.

One more point I want to make before turning it back over to Pete is that you folks, probably most of you, are not retired yet. We’re talking about retirees, but you folks are best placed to advise those who are in retirement or approaching retirement, or for that matter are pretty far from retirement, but should have begun thinking about it as early as possible. So with those admonitions, I turn it back to Pete.

Pete Neuwirth: Okay. So as we said, this stool, which is a passive thing, you sit on those three legs. And I mean, savings is something you accumulate, but the other two are something that’s just provided for you. In this world today, people are on their own. And so that’s why we’re calling it tools, three tools that you acquire over your life, your working life generally, and manage and take care of.

And how you acquire them, when you acquire them, and in what order you acquire them will vary from individual to individual. I mean, I have a friend and actuary who used to design pension plans, and he said if you’ve seen one pension plan, you’ve seen one pension plan. And that’s the way I feel about financial plans. I think if you’ve seen one individual’s financial plan, you’ve seen one individual’s financial plan.

We are all different. We all have different needs, circumstances, assets, liabilities, and the like. And consequently, each individual needs to acquire these tools and put together the stuff in their backpack that will sustain them and their families for the long term. Now I do want to put out one aspect of that. We say these are all tools you acquire over time, but there’s one tool, longevity insurance, that you probably should hold off on until it’s clear that that’s a risk.

Because you don’t know whether you’re going to live too long until you’ve lived for a while and still are around still looking around and get a little bit worried about living to 95 or 100 and having enough money. But with that caveat, basically, all the other three tools can be acquired at various times throughout your life and will serve you well in retirement.

A couple of other observations about these tools. We have their employer-provided retirement benefits, and those are benefits that are going to be provided by the employer as opposed to yourself. But you would be the individual the one who actually makes a choice as to where you work, and does that employer have a 401k? What kind of… Are you going to be taking a 10.99 gig, in which case you’re going to need to put aside money into an IRA?

So when we talk about 401k, I also consider IRAs as part of that too. And as a self-employed person, as many, many people are, since it is a sort of a gig economy, IRAs are important. The other point I would make here is that this is not the sort of thing that is always amenable to calculations and quantitative analysis. And I wrote a book about present value, but you can’t calculate the present value of everything. But that doesn’t mean it doesn’t have value.

For example, life insurance. This is a great thing to acquire, particularly early in your career, for a bunch of reasons I’ll talk about in a little bit. But what is the value of life insurance? Well, what is the value of security for your family as you’re building one? Well, actuaries can put some numbers on the value of life, but that’s not what life insurance will mean to an individual.

So I would caution folks not to get too hung up on the numbers and not get too hung up on the calculations as you’re accumulating these assets throughout your career and also be careful and be mindful as you take on debt. Because you might have to take on debt to acquire one or more of these assets. I mean, for example, a house, you’re going to have to get a mortgage.

And debt is truly a double-edged sword. It can enhance your financial health. It can amplify the returns you get on various assets and make you financially fragile. With those caveats in mind, let’s jump in and dive deeper into each of the three tools. And let’s go first to the one that’s probably the biggest asset that… Well, it is the biggest asset that many, many retirees have. And that’s why we’re talking about it first. So, Barry, why don’t you tell us about home equity?

Barry Sacks: Hold that for a second and keep it in mind. Think about home equity as not only a place to live, your home but as a financial tool. So let’s now go to the next slide and spell out a bunch of reasons that people… I’m going to be actually rather normative in this.

People should, most people, not everybody because as Pete points out, some people perhaps move around a lot, perhaps they don’t like being tied to a particular location, but most people should, that’s where I’m being normative, should have a home as early as they can, should own a home. There’s a message I often give, which may sound a little bit infantilizing, but it’s not meant to be. And that is, a home mortgage is a form of enforced savings.

It’s something one has to pay for the risk of being thrown out on the street by foreclosure. And it can’t be put off till later. You can’t just say, “Well, I’ll start paying the mortgage next year; I’ll keep living in the house now.” So that’s an important notion in terms of financial stability. If one intends to be in the same general location for a long time and is not into traveling around a lot, changing both locations and careers, then owning a home is a terrifically important thing to do as early as possible.

And here’s a list of at least nine reasons why a home is a valuable asset and, therefore, and I shouldn’t say, therefore, can commonly be a valuable financial tool. Obviously, it’s a place to live for the family, for the working people, I shouldn’t say person, but people and the rest of their family to live.

It provides shelter for friends and other relatives that come along to visit. And it’s a source of ready cash when perhaps necessary, it’s kind of a safety measure that one can get a HELOC, a home equity line of credit if unexpected needs should pop up. It’s also a means of building debt capacity, which means that if one pays the mortgage payments regularly, credit ratings are improved.

And here’s where I think it’s particularly important. It means building wealth that can accumulate or be invested elsewhere through cash-out refinancing. The source of income, if rooms are rented out or if it’s a multi-unit building, the notion of a home office has become extraordinarily important as the pandemic continues to rage. It’s a source of retirement income, and that’s what we’ll talk about more later.

And finally, it’s a legacy, although this is a much more complicated notion than it might appear because, as we’ll mention in passing, later on, the fact that a home and a defined contribution plan are used in conjunction with one another in coordination enables a larger legacy than might otherwise be available if only one of those two assets is used or if they’re not used in a coordinated fashion.

Okay, let’s go to the next slide. Now let’s talk a little bit more about the different points in life at which home has a different meaning. At the beginning of adult life, a home is just a place to live and an opportunity to begin to accumulate wealth on a safe leveraged basis. And leveraging’s important. It shouldn’t be over-leveraged because there’s too much volatility, but reasonable leverage, typically 70, 80%, is a good number one that has at least stood the test over the years.

Mid-career, the equity has begun to accumulate substantially. And as we know, although there’s volatility generally in the long run, home values have increased. So it’s a way that provides a source of money should that be needed to enhance a balance sheet by making other investments. In other words, as a part of diversification.

So as we said, home equity is the first leg of this new stool, but the others should not be forgotten. We’re not talking about a one-legged stool, we’re talking about a three-legged stool, but this often is and could very well be the strongest first leg. Next slide, we’ll look at the next stage of working life. Can you go to the next slide, please? There we go.

As one approaches retirement, I’m speaking to you folks as counselors and advisors to people who are contemplating retirement, whether they’re close to it, in it, or at a much younger stage, should already be thinking about it. And if they’re not, I would humbly suggest that you folks instill in your young clients that retirement, while it may seem very far away, comes at you like a train, like a freight train with a very… Like a bullet train, I should say.

I’m 83 years old, and it seems like only yesterday I was a 40-year-old and then a 60-year-old, and all of a sudden, wow, I’m 83. As you approach retirement, it becomes a major component of the total assets. And that’s significant. As I said before, for people who reach retirement, most people, about 70%, have the largest asset they have, even larger than their defined contribution account.

In retirement, it can be figured so that people can age in place with extra space being available for live-in care providers, or for that matter, the offspring will come back because they couldn’t find a job. And HECM credit lines that are in reverse mortgage credit lines can be an integral component of retirement income as a source of cash.

Well, if unexpected contingencies arise, I guess we’d have to say that the volatility of the retirement portfolio is expected or should be expected. And the ability to respond to it by using home equity as a buffer asset should be expected, planned for, and built into one’s retirement planning. And then finally, the home can be left to heirs. And although I’ve only seen it a few times before, I said never, the next generation occasionally should take the house, refinance it and stay in it for the next generation.

Pete Neuwirth: Barry, before we get into insured products, can you just foreshadow just a little bit of your coordinated strategy? I think this is absolutely critical for the people in the audience, that the use of home equity as a retirement income strategy or as part of a retirement income strategy is critical, and it’s why, I mean, why I believe home equity is a critical tool to have in your back pocket.

Barry Sacks: It’s crucial. Let me give a simple little arithmetic example. Imagine a securities portfolio in a 401k or rollover IRA or not. Whenever it’s in, imagine that it’s valued at $100, and this scales perfectly, so I don’t care how many zeros you want to add after it. Assuming that, as expected, that portfolio will lose 20% at some time along the way. Now it’s down to $80.

In order to come back to its previous position of $100, it has to gain 25%. It’s lost 20% of 100, but to gain back to 100, it has to earn 25% of the remaining 80. Suppose that after it drops from 100 to 80, a $5 draw distribution is taken from that portfolio; now, it’s down to 75. To get back to 100, it has to earn not 25% but 33%. That’s a much harder burden, a much harder nut to crack.

The lesson from that little bit of arithmetic tells us is that when a portfolio is down, don’t draw on it. It is sometimes, they call it kicking the bear, sometimes they call it something else that you shouldn’t draw if you can avoid it on a portfolio that has a downturn in its volatility cycle. Instead, draw on another asset that isn’t subject to the same volatility. It’s called a buffer asset.

And a buffer asset, the most readily available buffer asset for most people who are in retirement is their home equity, which can be drawn upon through a home equity credit line, a HECM credit line so that you can allow the whole portfolio, not just the piece left after the money has been taken out to recover. And we’ve shown using Monte Carlo simulation in an article that I wrote with my brother, Professor Steve Sacks, in 2012, and that Pete and I wrote a follow-up article in 2017; both are in the Journal of Financial planning.

The latter one is 2017 October. So anyway, the point is that throughout quite a range of ratios of home value to portfolio value, you can see that the use of the port of the home equity line of credit, the HECM of the line of credit can allow the assets, the cash flow to be sustained at a much higher level for a much longer period than if they weren’t used or if the home equity was used only as a last resort, which was the common wisdom until we kind of showed that that’s not the best way to think.

Pete Neuwirth: Speaking of buffer assets, another kind of lesser buffer asset, less important or less significant for most people than home equity, is the cash value of any life insurance policy one might have. That’s just one aspect of life insurance which is just one form of insured products, which comprise what we’re considering as the second tool to be in the backpack.

So whether this is a new three-legged stool, or as I like to think of it, three tools that you get and put in your backpack as you soldier into the financial wilderness, insured products of both kinds are pretty important. And insurance companies insure both more against mortality and longevity. That’s partly why they’ve been in business, for some of them have been in business for over 200 years because whatever.

If there are the risks of people living longer and longer and longer as mortality improves and medical advances, they don’t go broke because they’ve also got risks on the other side of the ledger to balance their books and stay in business. And so there’s a bunch of life insurance, and there’s a bunch of longevity insurance products out there. We’re going to talk about not term insurance, which is pure insurance, which is in a whole different category; it’s kind of like medical insurance.

What we’re going to talk about is permanent cash value life insurance. There are three kinds. There’s whole life, there’s variable, universal life, and there’s also index universal life which is kind of a newish sort of product that is becoming more and more popular. And then longevity insurance, annuities come in all kinds… there’s a wide variety. There are immediate and deferred, fixed and variable.

You can have a cash refund feature that builds in. So some death benefits into the annuity so that you’re actually covered in case you die. On the other hand, I’m not sure a cash refund annuity is such a great idea because you’re trying to buy two insurances at the same time, and probably not the most efficient thing to do. But there are also other forms you can protect your spouse or other partners through joint and survivor options.

And you can get them through both life insurance companies and also from big foundations and charities. But making the distinction, we’re not talking about charitable remainder trust, we’re talking about charitable gift annuities, which are pure annuities that you get from an insurance company. So let’s move to the next… Yeah, life insurance.

So life insurance gets a bad rap. And maybe even some of the folks in the audience are saying, it’s inefficient, you should buy term and invest the difference. And while that’s true, it’s from an “efficiency standpoint”, it’s sort of the difference between using a scalpel and a Swiss army knife. A Swiss army knife is not as sharp as a scalpel, but it has lots and lots of other uses that you can put to as life goes on.

In fact, what I’ve listed here are six different ways a life insurance policy can be used. The first is that of accumulation of savings, cash value savings. I bought my first life insurance policy in 1979. And that you could say, well, is life insurance a good idea in an inflationary rising interest rate environment?

I can tell you from personal experience that the answer is a definitive yes. That as insurance companies have a very well-thought-through insurance strategy, they buy long-term bonds, and hold them to maturity. And so they profit on the way up as interest rates go up, and they profit on the way down by being able to provide higher dividend rates than would be normally available with current rates.

So cash value accumulation is important, and tax-free death benefits are very important, particularly as you build a family. The surrender value can be borrowed against when you need to expand your financial world and maybe even buy a house. I mean, these tools can be used in combination. And then, of course, once a policy’s paid up, that’s when you can start to consider using it for retirement.

And either retirement income or surrender it and do something else with it. It’s a legacy because that’s what it is. I mean, eventually, everyone is going to die. And if you’ve got a life insurance policy when you die, that money gets passed on to your heirs. So let’s go to the next slide, okay? Longevity. Okay, so longevity insurance, I mean, annuity, there’s lots and lots that have been written about annuities.

And I do believe in annuities, I have a couple of variable annuities myself. And I do have a fixed annuity, but it’s a fixed annuity because I’ve got a defined benefit pension plan. So I’m one of the lucky few to have. So I don’t need to go out and buy a fixed life annuity, but I do have… Actually, I do have a fixed annuity, I take that back. I bought a charitable gift annuity from my old school a while back, and it provides guaranteed income as long as I live.

But again, here’s the range and various uses that longevity insurance and annuities can provide particularly. And I’m not going to spend… Why don’t we just flip to the next slide? And these next two slides basically show you how to use insurance policies and insured products as you go through life. And again, I’ve used my cash value and whole life insurance policies, and I’ve got four of them now.

And I’ve used them from the beginning when I started accumulating assets, I’ve used them in the middle of my career when I borrowed against them to… I don’t think I borrowed to buy a house, but I have borrowed it for various reasons. I think I borrowed it to renovate my house. When I was raising a family, it provided me great protection just in case I died, but happily, I didn’t.

And going to the next slide. As I approached retirement, I started to consider how that could be used in retirement. And again, we don’t have to get into… I don’t think we have time to get into all these nuances. And for those who want to talk more about insurance products, life insurance, and annuities, I’m always available because I believe in the insurance industry and the products they provide. Now I turn it back to Barry to discuss the third and final tool to put in your back pocket.

Barry Sacks: So let’s look at the next slide and just kind of look at the happy colors, the happy design of this final segment of our presentation. So this is employer provided retirement programs and the other one, the government provided retirement program, social security. Now let’s go to the next slide. And let me point out one thing before we get into any detail here, and that is when we use the terms employer and employee, we mean them in the broadest sense.

That is, it includes not only rank and file employees. It includes middle level management. It includes upper level management of companies. It includes partners in partnerships and employees of partnerships. It includes gig workers as well, because although they would be called self-employed, they’re both the employer and the employee. So all of our comments apply to them as well.

And indeed somebody who’s a gig worker and who by having the so-called employer fob off onto them the responsibility of being their own employer, that entitles them, that the flip side of that, that is that although the so-called employer, what I would call the real employer does not provide any benefit because they claim they’re not the employer, then these individuals should think about setting up a Keogh plan if not an IRA.

So these are important notions. This is a very broad range of people. Anybody that works in any capacity we’re including in the definition of employee or for that matter, many in the definition of employer. Now, one more bit of anecdote before I get into some details, as Pete pointed out, and I kind of intimated, I got out of law school in 1973, and through the ’70s, remember, I started off as an ERISA lawyer and stayed an ERISA lawyer for the next half century.

When I got out of law school, most plans were defined benefit plans and most employees that were covered by a plan were covered by defined benefit plans. As time went on, the number of defined contribution plans exceeded finally surpassed the number of defined benefit plans. Still the number of employees covered by defined benefit plans exceeded the number of employees covered by defined contribution plans.

But finally, by the ’90s, it had gone all the way to defined contribution, that is there were more such plans, more defined contribution plans than defined benefit plans and more people who are covered by plans were covered by defined contribution plans than defined benefit plans. Okay, with that said, the focus then is on defined contribution plans because there are more of them and more people are covered by them.

And that’s what I know more about anyway and Pete knows more about defined benefit than I do. Anyway, the point is that a defined contribution plan for the most part consists of a securities portfolio. That’s what’s there. It’s a securities portfolio, and when the person, the employee retires, he or she has to live off of that securities portfolio. The risk of exhaustion is on the employee, not on the employer, not on the plan sponsor.

We have to think in those terms, and we have to make sure that we do the best we can. And I say we meaning you as advisors and counselors to the plan participants. We as advisors and counselors to you have to think about these things and have to do the best we can to figure out what’s the best way to manage them.

So the first thing, the first phase is to advise that to the greatest extent possible, the employees, the participants in these plans, to the extent they’re allowed to make contributions in the 401k model, they do so, to the extent that they can benefit from employer matches or the employer contributions, that they do so. They have to keep thinking in those terms.

When the participants have investment options, they should think in the long term and not shoot for the moon trying to make a killing on Bitcoins, or God knows what else. Keep thinking in terms of, and again, I say keep thinking, you should keep thinking as advisors to these folks, these participants in terms of a good diversification of investments, and think in the long term.

Ultimately, social security benefits will be based on earnings history. And that’s not something that is within the control of the employee except to the extent that if they’re choosing between jobs and all other things being equal, they should seek the higher paying job. Okay, next slide, please.

Pete Neuwirth: So I’m going to talk a little bit about just for a couple minutes because we really only have a few minutes about again, employer provided retirement through your career. Now I got lucky. I mean, again, I really did get lucky.

I have worked for companies that had very generous defined contribution plans, even though the defined benefit plans were prevalent in the ’80s, the very generous profit sharing plans that accumulated and 401ks that accumulated quite a bit of money in my early years, which then the power of interest over time turned them into a pretty nice retirement thing. At the end of my career, I worked for a couple of companies with defined benefit plans. So you can’t… I don’t know, like I said, it was kind of a weird confluence of events that caused that.

But throughout that career, as you change jobs and people will change jobs, I mean, I probably work for seven different companies in my career, being able to roll over and not spend the 401k has helped me accumulate a decent retirement. And then of course, as you approach retirement, the decisions get a little trickier and the issues more complicated and Barry, I don’t know if you have a comment or two to make on that before we talk about… But maybe we don’t have time.

Barry Sacks: One more thought I want to add, and again, it sounds trite and it sounds corny, but we’re all subject to the horrific onslaught of advertising. Buy this, buy that, get a new SUV, get a bigger flat screen TV. And the point is that those things very often cut into what would otherwise be savings. And we really have to, as Pete pointed out at the very beginning, for retirement, we’re much more on our own than we used to be.

On our own implies among other things, a measure of discipline, financial discipline. And that discipline means being aware of and resistant to all the importuning of advertising to buy this, do that, take that trip around the world that you’ve always wanted to take. It doesn’t mean live a monastic life, but find a balance. And again, fitting into the very message of this presentation, everybody has to find their own balance.

But the notion of balance, the notion of remembering when you’re young, that you’re likely to be old and it comes on pretty quick should be uppermost in one’s mind. And again, you folks are advisors to all the participants in all the plans that we’ve got. And it does sound corny, and it does sound trite, but I guess once you get older, you’re entitled to pontificate and provide this kind of advice that young people may reject as just old people forminating. But when you get there and you’ve had a measure of discipline, of financial discipline in your life, you feel pretty good about it.

Pete Neuwirth: Right. We want to leave a few minutes to talk about the decumulation problem, which is a big issue for retirees and as you plan for retirement. There are five basic risks that our viewers can read through. The first two are there during the accumulation phase, and the last three are very important and they are only there in the decumulation phase. There is no closed form solution to the decumulation problem, but Barry and I and many others have been chipping away at it. And over time, hopefully you guys, you advisors can help others deal with accumulation. And I think, unfortunately we’re kind of out of time. So maybe, I don’t know who’s supposed to take over next, but whoever it is.

Christian Mills

Christian Mills: Gentlemen, the importance of this and why I came to the industry from the defined contribution space is aha realization. I actually read that article. I started working for FPA in January of 2012 when that article came out, Barry, that there’s almost 11 trillion in equity for Americans 62 and above. They have the highest percentage of home ownership at almost 80%. It is another portfolio hidden in plain sights.

And I want to scream from the rooftops to financial advisors how this can help, especially in my opinion, the mass affluent not outlived their retirement. Let’s move forward Rick. So I think one of the biggest things, didn’t really hear it so far, but in depth of what’s happened at least in the HECM space or reverse mortgages in general they started actually in the last century in Europe.

I mean, we’ve always been able to borrow against property once we had this concept of personal property. The first HECM or the first reverse in the US was in the Midwest in the early ’60s, signed into law under Reagan in ’89. And let’s fast forward really to 2017, we made some really good changes establishing HUD counseling in 2001 which helped eliminate conflict of interest and introduced a independent third party.

We introduced financial assessment in 2015 which RMF, our predecessor that we were working with at back when most of the folks here worked at MetLife. And then in 2017, and really kind of a watershed timeframe for making this truly a financial planning tool, they lowered the principle limit, which is kind, I think of that as loan to value. And while some people bemoan that, what it did is it added longevity to the program hopefully with the idea that this is going to become more and more mainstream.

And in this year, we raised the HECM loan limit to just shy of a million dollars. So if you think of this as the social security wage cap, for at least the federal program under FHA and HUD, we can consider the first $970,800 of that home. So not a loan of last resort by any means. And Rick, if you want to launch the first polling question, that would be great. And this is for us to get information.

If you’re interested at all in hearing about what this might look like for one of your clients, we can show you how this will work. We can actually do it in MoneyGuidePro, eMoney. We can forecast it in RightCapital, NaviPlan. So if you’d like us to reach out and let you know, here’s what this is. We don’t need personal identifying information, but this will tell us that you’re interested in hearing from us. All right, Rick, we’ll take that down.

And let’s move forward, please. And let’s go ahead and move one more. We know it’s your money you can do with it what you want basically with a few restrictions. Really what’s important about reverse mortgages, I think it actually starts on the left hand side of the screen you don’t see, which is can education. I tell people you should walk toward a reverse, not run toward it.

Once you make that decision, it takes about six weeks in our current environment. You have to get counseling. We do the application, gather documents, then we go into underwriting. That’s when we get an independent third party appraisal and that’s where we get the number that is going to dictate what things look like at the closing and the funding of the loan. Managing the HECM, they last about eight years on average before there is a maturity event, which is on the right side.

Maturity event is either mortality, mobility issues forced them from the home or they refinanced. And actually without getting into it too much, foreclosure is a natural ending to reverse mortgages where there are not heirs or family involved. So let’s move forward, Rick. And I’ll talk about this a little bit. Rick, you want to launch the last polling question, I’m going to get back to these guys for questions here.

So Equity League is our proprietary product. As reverse mortgages came into their own, some of the larger companies direct lenders. And again, if you have clients making mortgage payments, I’m sorry for the polling question. If you’d like to see an illustration, we can certainly do that for you. And if you want to take that back, oh, thanks.

So proprietary products, some people think of as jumbo, but really, it just makes sense in certain situations. And with today’s uncertain interest rate environment for financial planners, sometimes this makes sense really as a planner, when you’re looking at your clients using home equity, the basics are there’s on one end where we’re removing a payment.

So if you have a $2,000 mortgage payment, about 1500 roughly is principle interest, that frees up 1500 in cash flow. And on the other side, if it’s paid off, we’re going to access hundreds of thousands of dollars potentially in unrealized funds in a portfolio to help that person offset the cost. And I can’t tell you how happy I was to hear you talk about buffer assets because that is certainly aligned with this.

So private labor products, we can loan up to 4 billion on homes worth up to 10 million, goes down to the age of 55. So we’re starting to use home equity for people in the generation X generations. So this is the ability to just expand on the reverse mortgage space from the HECM and move on to there. Let’s move forward, Rick.

And really what’s important here is we need to know as a planner, what would you like this to do for your client? What do they want to do? Do they want to move closer to family? Do they want to fund a charitable trust of some kind and leave a legacy? Are they looking to help children or grandchildren go to school or buy their first home? It’s really up to you, but tell us what you want to do and that helps us take down about 90 different variables and options and come up with two or three that make the most sense to look at.

And Rick, if you’ll just show what we need to do to get a reverse quote, that would be great. That’s just a quick picture of our forecasting tool, the Optimizer. What we need to get a quote is just the age of the youngest client, estimated home value. Zillow is a great place to start. We’ll dial it in from there. Total mortgage debt, so forward mortgage, or HELOC against it. If any end zip code helps us predict taxes to a certain degree.

We don’t need identifying information, we don’t need full names, social security numbers. We could run a scenario with that and send it to my friend, coach Rick McFadden who’s driving this boat today, thank you, coach, at the financial advisor education desk, or send it to advisors@reversefunding.com. So thanks for putting up with that commercial. Let’s switch back to Rick, if you could, to the contact info for Pete and Barry. And I have just a couple of questions for you guys. All right.

So I left the DC space and went to work for the financial planning association from 2012 through 2017 and then got my mortgage license. And I’m curious what your thoughts are, what you think it would take to normalize, validate, make home equity a more recognized tool for financial planners especially for the mass affluent gentlemen, because that’s where we’re really see this makes a huge impact.

What do you think it would be? Because 10 years ago, you needed a… I think you had to have a Keogh to buy an ETF. And now they’re very mainstream but we only tap 2 1/2% of the eligible people that are eligible for reverse mortgage, only 2 1/2%, actually little less than that. We could double the entire industry and still be less than 5% market penetration. Just some thoughts on what it would take to do that. I’m very interested in that.

Pete Neuwirth: I’m going to let Barry handle this because my own view is it’s inevitable, that this is a… When I worked in the corporate actuarial consulting world for many years, people talked about the retirement crisis, that there’s a retirement crisis. People are not going to have enough to live on because they’ve been spending their 401ks, they’ve been taking lump sum distribution and buying yachts.

I just don’t believe it because I believe that there is enough assets, there are enough assets for people to live on in retirement because of home equity. And it will be inevitable that this market will emerge and almost everybody who needs one will have one, but that’s my own view.

Barry Sacks: I agree. I’ll invoke the great sage Malcolm Gladwell, author of the Tipping Point. I think that we’re still far from a tipping point, but if we get there. And unfortunately, it’s more an if than a when. If we get to the point where enough… I guess they’re called what? Influencers? The decision to do it, then other people will recognize the validity. It’s absurd because, typically, influences are not really people who have fought any more deeply than the people whom they influence.

Barry Sacks: I agree. I’ll invoke the great sage Malcolm Gladwell, author of the Tipping Point. I think that we’re still far from a tipping point, but if we get there. And unfortunately, it’s more an if than a when. If we get to the point where enough… I guess they’re called what? Influencers? The decision to do it, then other people will recognize the validity. It’s absurd because, typically, influences are not really people who have fought any more deeply than the people whom they influence.

Nonetheless, I feel that by keeping on doing things like we’re doing, keeping on putting the message out to the financial planners, putting the message out to anybody connected with the retirement industry, which includes not only financial planners but all the people who are contacting all the employers to put in a 401k, to help them do it, to run the investments, in fact, I guess the investment folks are maybe the most likely ones who could get the messenger, that is, understand it, and then reconvey it would be what would lead to the tipping point that I think we’re looking for.

One thing that is not very well understood by the financial industry, the mutual fund industry, is how most typical 401k plans are funded; that is, most investments are not in securities directly but indirectly through mutual funds. If the mutual fund people recognize that it’s in their economic interest and in the interest of all the investors to basically rationalize the retirement, then they’ll make more money because the portfolios will last a lot longer.

And I did a little calculation at one time using a very simple… I can’t remember whether it was 1/2% or a 1% management fee, and the result was that in the long run, and I present valued it back, so we’re not looking at trying to say, well, they’re going to make a whole lot more money 30 years from now, but I present valued it back so that at least in present value, they’re making essentially a 5% increment using the coordinated strategy rather than the last resort strategy.

Because remember, the last resort strategy exhausts the portfolio first. So to the extent that it’s exhausted, the mutual fund companies no longer make any money. So they have a great interest in being continued.

Christina Mills: Thank you so much Barry and Pete!