Meet Pete

A Note from Author and Actuary Peter Neuwirth, FSA, FCA

I began my actuarial career when I graduated from Harvard College in 1979 (with a degree in Mathematics and Linguistics) and went to work at Connecticut General Life Insurance (now CIGNA). For the next 38 years I worked continuously as an actuary holding significant leadership positions at a variety of firms around the country including most of the major consulting firms (Aon, Hewitt Associates, Watson Wyatt, Towers Perrin and finally Towers Watson) as well as spending 5 years as chief actuary at a regional benefits consulting firm (Godwins), 7 years running a small actuarial firm (Coates Kenney) and one year in a large accounting firm (Price Waterhouse). At the end of 2016 I retired from Towers Watson to focus on writing and researching financial wellness issues.

Toward the end of my career at Towers Watson I began to focus on financial wellness in earnest and in 2015 Berrett-Kohler published my book “What’s Your Future Worth?” Shortly thereafter, I blogged regularly for a couple of years and more recently have begun consulting to individuals around their overall financial plans utilizing the material from my website as a basis for the practice.

More recently I have been blogging about how the principles of Holistic Financial Wellness can be utilized to weather the economic crisis that has befallen us. This has led to unsolicited calls to provide tactical advice to those who see their financial life in danger of collapsing. To the extent you are interested in such help, please send me an e-mail and I promise to respond. It may or may not become a business for me, but right now I just do it for people who find me and ask. It is what I love to do, but I am only interested in working with people who want my help.

I am still a practicing actuary, working part-time for CapAcuity (an Executive Benefits consulting firm) and regularly take on consulting assignments for other corporate clients. I also serve as an outside director for Rael and Letson, a mid-sized actuarial consulting firm specializing in Taft-Hartley plans providing them advice on governance and strategic issues.

I continue to conduct actuarial research on using home equity to generate retirement income and in 2018 taught a graduate seminar on the subject for the actuarial science department at the University of California at Santa Barbara. I am currently associated with the Academy for Home Equity in Financial Planning at the University of Illinois.

I have had a broad and wide-ranging actuarial career, and as a result I am well-known within the actuarial community. While most of my career has focused on US issues, during my tenure at Towers Watson, I also had the opportunity to work for a year in our Paris office consulting with multi-national corporations headquartered in Europe. As it happens, my assignment in France took place during 2008 and 2009 and as a result I had the unique opportunity to view the unfolding of the global financial crisis from the perspective of an American actuary doing business in Europe. This experience gave me a much deeper appreciation for how cultural differences inform our assumptions and attitudes toward fundamental concepts (like time, risk and money) and thus shape our world view.

In addition to my first book, What’s Your Future Worth? Using Present Value to Make Better Decisions, I have published several articles in professional journals (e.g. Journal of Deferred Compensation, Contingencies, Journal of Financial Planning etc.) and am a frequent speaker at professional conferences (e.g. Conference of Consulting Actuaries, Enrolled Actuaries, Western Pension and Benefits Conference etc.). My newest book is Money Mountaineering: Use the Principles of Holistic Financial Wellness to Thrive in a Complex World. I have also been quoted in both the mainstream and industry press on actuarial matters. And, I am a Fellow of the Society of Actuaries and a Fellow of the Conference of Consulting Actuaries.

My Philosophy

One of the key tenants of being an actuary is to be VERY careful about what you know and what you don’t know. Actuaries are guilty to a fault of declining to venture opinions when they are not sure they know the answer. In general, I think this is a good thing and we can all use a little humility in the face of the vast complexity that we face, but that doesn’t mean we should give up on trying to understand more. My father was a code breaker for the US government and while he couldn’t tell me anything about what he was working on, throughout my childhood I was always aware that there were codes and messages out there that were almost impossible to decipher completely, but every once in a while, with a concerted and focused effort some of the signal could be separated from the noise.

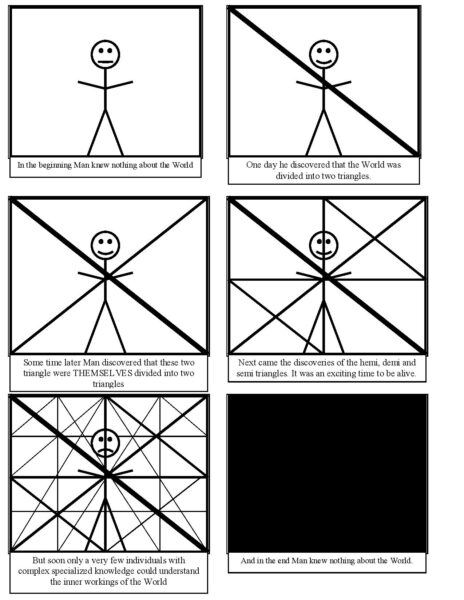

I believe that not looking at what is going on around us is a recipe for ignorance and catastrophe, but I also think that if you look too deep, the complexity will overwhelm you. For me it’s the hemi, demi and semi triangles that give you the clue to what is going on. That’s where I spend my time and I invite you to join me on my exploration of where they are and how they affect our lives.

Perhaps the following cartoon (given to me by a particle physicist) expresses it best.

Connect with Pete:

- Office: 109 W. 7th Street, Santa Rosa, CA 95401

- Website: peterneuwirth.com

- Email: peteneuwirth@gmail.com

- Call: 707.537.5075

- Book a speaking engagement with Pete: Contact Hope Katz Gibbs, director of communications, by cell: 703-346-6975 or email: hope@hopegibbs.com