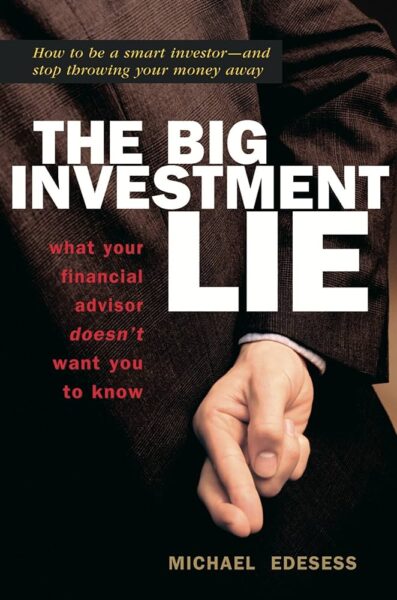

December 2023: Meet Michael Edesess, accomplished mathematician and economist and author of The Big Investment Lie, and The 3 Simple Rules of Investing. Our topic: Understanding Crypto

Season 2: Episode 4 of Money Mountaineering with Peter Neuwirth features Michael Edesess, author of “The Big Investment Lie,” and “The 3 Simple Rules of Investing”

A Note from Actuary and Author Peter Neuwirth, FSA, FCA, host, “Money Mountaineering: The Sharing Economy” — I invite you to tune in for this week’s episode of my podcast and video show, Money Mountaineering, where for 30 minutes, financial experts help us answer the question: What’s your future worth? In the fall of 2023, we launched Season 2, where we focus on the power of the Sharing Economy.

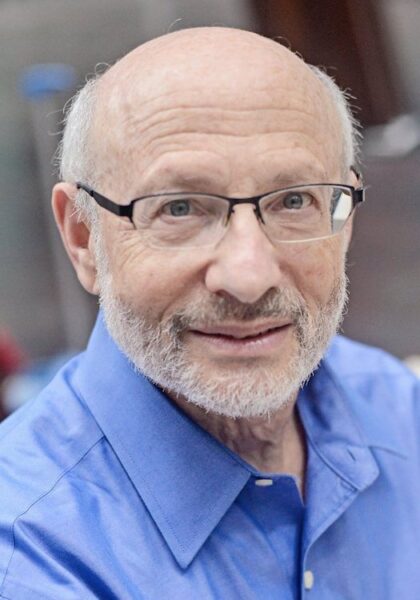

Meet the month’s guest: Michael Edesess, accomplished mathematician and economist and author of The Big Investment Lie, and The 3 Simple Rules of Investing

Our topic: Understanding Crypto

Pete explains: Michael was part of the first wave of math and physics PhDs who became investment advisors in the early ’70s and understands better than almost anyone I know how easily confused and misled people can get when overly complex or inappropriate mathematics is used to ‘sell’ investment products. I grew up in Princeton with several other mathematicians (including Jim Simons) who became the original Quants. Like many innovations in the world of money, mathematical models have their place in investment management but have often been used unethically and inappropriately to keep clients in the dark and generate fees far in excess of the value provided. Michael’s book, The Big Investment Lie, does a great job of exposing those tricks and shines a light on just how hard and uncertain investing is. Nassim Taleb wrote Fooled by Randomness, which describes all the ways that our inability to understand how probability works in the real world leads us to make mistakes with our money. Michael’s book could easily have been called “Fooled by Complicated Math,” as math confusion is yet another thing that gets in the way of people thinking critically about their money.

Pete explains: Michael was part of the first wave of math and physics PhDs who became investment advisors in the early ’70s and understands better than almost anyone I know how easily confused and misled people can get when overly complex or inappropriate mathematics is used to ‘sell’ investment products. I grew up in Princeton with several other mathematicians (including Jim Simons) who became the original Quants. Like many innovations in the world of money, mathematical models have their place in investment management but have often been used unethically and inappropriately to keep clients in the dark and generate fees far in excess of the value provided. Michael’s book, The Big Investment Lie, does a great job of exposing those tricks and shines a light on just how hard and uncertain investing is. Nassim Taleb wrote Fooled by Randomness, which describes all the ways that our inability to understand how probability works in the real world leads us to make mistakes with our money. Michael’s book could easily have been called “Fooled by Complicated Math,” as math confusion is yet another thing that gets in the way of people thinking critically about their money.

Pete will ask Michael the following:

Tell us about your overall philosophy regarding how an individual who doesn’t have a math background should rationally (and critically) think about their money and how to manage it.

Tell us about your overall philosophy regarding how an individual who doesn’t have a math background should rationally (and critically) think about their money and how to manage it.- Share some examples of things that many believe about investment management but can be shown to be false when you understand the math and study the data.

- Among the most complicated and least understood investments many people own is cryptocurrency, particularly Bitcoin. You have been studying it for years and taught the first university course on cryptocurrency in Hong Kong in 2017 at The Hong Kong University of Science and Technology, just as the crypto craze started. Tell us about the history of this trend.

- You recently published a comprehensive review of Michael Lewis’ book on Sam Bankman-Fried in Advisor Perspectives. Tell us about that review and where you see the future of Bitcoin heading — as a hedge against a declining dollar and/or as part of one’s investment portfolio.

About Michael: An accomplished mathematician and economist with experience in the investment, energy, environment, and sustainable development fields, Michael is the coauthor of The 3 Simple Rules of Investing: Why Everything You’ve Heard about Investing Is Wrong – and What to Do Instead, as well as author of The Big Investment Lie, both published by Berrett-Koehler. He is currently an adjunct professor in the Division of Environment and Sustainability of The Hong Kong University of Science and Technology.

Michael writes regularly for Advisor Perspectives and other publications, has spoken at conferences on investment research, and has taught courses in international finance, mathematics, statistics, systems analysis, and energy and environmental economics at six universities. His articles have been published in the Wall Street Journal and the Journal of Portfolio Management, and he has been interviewed on a number of radio and TV stations.

He was a founding partner in 1995 and chief economist of the Lockwood Financial Group until its sale to The Bank of New York in September 2002. Previously an independent consultant to institutional investors, his clients included several of the largest investment banking and consulting firms. He holds a bachelor’s degree from the Massachusetts Institute of Technology and an M.A. and Ph.D. degrees in pure mathematics from Northwestern University. In addition to his work in investments, Dr. Edesess is active in environmental and resource economics and international development.

Michael chaired the board of International Development Enterprises USA, a nonprofit focusing on increasing the wealth of poor rural smallholders in developing countries, and he has chaired the board of Rocky Mountain Institute, a prominent energy think tank in Snowmass, Colorado, and the Rocky Mountain Advisory Board of Environmental Defense. He has written for numerous publications and spoken at conferences on energy, sustainable development, economics, and investment. His articles on these topics have appeared in Technology Review, Rising Tide, the Christian Science Monitor, Rocky Mountain News, and Pensions and Investments. Click here to learn more about Michael and his books!

About Peter Neuwirth, FSA, FCA: Pete is an actuary specializing in retirement plan issues. He is a 1979 graduate of Harvard College with a BA in Mathematics and Linguistics. After leaving Harvard, he went to work at Connecticut General Life Insurance, now CIGNA, and for the next 38 years, he worked continuously as an actuary holding significant leadership positions at a variety of firms around the country, including most of the major consulting firms (Aon, Hewitt Associates, Watson Wyatt, Towers Perrin and finally Towers Watson). He spent 5 years as a chief actuary at a regional benefits consulting firm (Godwins), 7 years running a small actuarial firm (Coates Kenney), and one year in a large accounting firm (Price Waterhouse). At the end of 2016, he retired from Towers Watson to focus on writing and researching financial wellness issues.

About Peter Neuwirth, FSA, FCA: Pete is an actuary specializing in retirement plan issues. He is a 1979 graduate of Harvard College with a BA in Mathematics and Linguistics. After leaving Harvard, he went to work at Connecticut General Life Insurance, now CIGNA, and for the next 38 years, he worked continuously as an actuary holding significant leadership positions at a variety of firms around the country, including most of the major consulting firms (Aon, Hewitt Associates, Watson Wyatt, Towers Perrin and finally Towers Watson). He spent 5 years as a chief actuary at a regional benefits consulting firm (Godwins), 7 years running a small actuarial firm (Coates Kenney), and one year in a large accounting firm (Price Waterhouse). At the end of 2016, he retired from Towers Watson to focus on writing and researching financial wellness issues.

Pete continues researching various financial wellness issues, including using home equity to generate retirement income. In 2018 he taught a graduate seminar on this subject for the actuarial science department at the University of California at Santa Barbara. He is currently associated with the Academy for Home Equity in Financial Planning at the University of Illinois.

In addition to his books “Money Mountaineering” and “What’s Your Future Worth?”, his research has been published in professional journals, including the Journal of Deferred Compensation, Contingencies, and Journal of Financial Planning. His articles have also been published in numerous online actuarial web publications. He is a frequent speaker at professional conferences such as the Conference of Consulting Actuaries, Enrolled Actuaries, and Western Pension and Benefits Conference. He is a Fellow of the Society of Actuaries and the Conference of Consulting Actuaries.

Click here to learn more about actuary and author Peter Neuwirth: www.PeterNeuwirth.com • Listen to our podcasts on PeterNeuwirthRadio.com • Watch all of our episodes: www.PeterNeuwirth.tv