“Silver Divorce can be painful,” knows actuary and author Peter Neuwirth who, with his associates, offers ways to ease the financial burden

Peter Neuwirth & Associates launch Silver Divorce Consulting. Having been through the process themselves, these professionals offer insights and solutions to the challenges of getting divorced in your senior years. Scroll down to read about Pete’s insights, starting with the 2020 California wildfire that not only took his home but changed how he looks at money, business, and life. Click here to read more about how Pete can help you through your Silver Divorce.

A Note from Peter Neuwirth — Having my house burn down in a California wildfire taught me much about risk. In the last chapter of my second book, Money Mountaineering, I muse on the difference between financial forest fires and “real” ones like the Glass Fire of September 2020, which destroyed my home in Santa Rosa just before I completed writing the book and submitted it to my publisher.

A Note from Peter Neuwirth — Having my house burn down in a California wildfire taught me much about risk. In the last chapter of my second book, Money Mountaineering, I muse on the difference between financial forest fires and “real” ones like the Glass Fire of September 2020, which destroyed my home in Santa Rosa just before I completed writing the book and submitted it to my publisher.

Three years later, I see now that the distinction between unforeseen events that destroy our physical possessions and those that burn up our financial resources is more apparent than real. This was hammered home to me when, less than 2 months after my house was destroyed—on November 19, 2020—my wife of 21 years filed for divorce.

I shouldn’t have been shocked since I had already moved out of our Berkeley home in March, shortly after the pandemic lockdown made living in the same house unsustainable for us. Still, the timing of her filing could not have been worse, as I was still living in temporary quarters. Many of the paper documents and financial statements necessary to deal with a legal/financial transaction like a divorce had been incinerated in the 2000-degree heat that had transformed my home into an unrecognizable pile of rubble.

For several months, I tried to negotiate an amicable and peaceful end to our marriage. For a while, I was hopeful that the financial cost of my divorce would be an example of the kind of unpredictable contingent expense (i.e., “spike expense”) that is almost inevitable during a long retirement.

It was during the early part of 2021 when I was still hopeful of a quick settlement, that I began writing about how much of a financial risk divorce poses to those planning for retirement and how optimism bias can cause you to underestimate the probability of it happening to you.

Two of those pieces can be found on my website silver-divorce-spike-expense-risk-and-3-other-risks and optimism-bias-can-raises-financial-risk-in-divorce. I believe these essays are worth reading and will provide some thoughts not just on the nature of the risk but steps that are worth considering before marriage that can mitigate, at least somewhat, the financial consequences of divorce.

Where I am now.

As my divorce has dragged on, I have realized that a “Silver Divorce” (i.e., a divorce that occurs when one or both spouses are over age 55) is much more than a spike expense. Divorce can be an existential threat to one’s entire financial world, and watching one bank account after another get “burned up” by legal and professional fees can feel very much like watching a wildfire rage through your financial life, gradually consuming everything you have accumulated over many years of work and saving. Since survival is the critical measure of navigating the financial wilderness successfully, I took it upon myself to look more deeply into how these wildfires get started and spread. In the last three years, I have learned much more about the legal/financial process of Silver Divorce than I ever intended.

Still, after I understood better why it is so expensive, I began considering what could be done to extinguish this kind of fire and make it less dangerous to the financial health of those who have not yet fallen prey to this particular life risk.

I have discovered that getting divorced, particularly if one or both spouses are willing to litigate, is a qualitative and quantitative risk different than many other spike expenses that can occur during retirement. Unlike more easily managed sudden unexpected expenses like a roof repair or a sudden medical emergency expense, the cost of a silver divorce is exacerbated by the time it takes to resolve and can be significantly increased by both a spouse who wants to fight and an ecosystem of lawyers, forensic accountants, CFP’s, CPA’s, CDFA’s and other “experts” whose financial objectives may not always be fully aligned with those of the couple who is getting divorced.

When it comes to Silver Divorce: Time is money in more ways than one. Having experienced it myself, I have learned much more about just how dangerous divorce can be to your financial health—particularly for those close to or at retirement age and for those who have accumulated assets that are both significant in terms of value and complex in terms of how they must be used to generate income. Divorce is a financial risk that everyone should be aware of regardless of age, but when it occurs at or near one’s retirement age, the consequences are much worse. Now being in the unusual position of being both an expert in this area and someone who now has first-hand knowledge of the financial impact of divorce, I decided that it was incumbent upon me to try and do something to help preserve the assets and future income streams of couples facing the same daunting challenges I faced in unwinding my marriage.

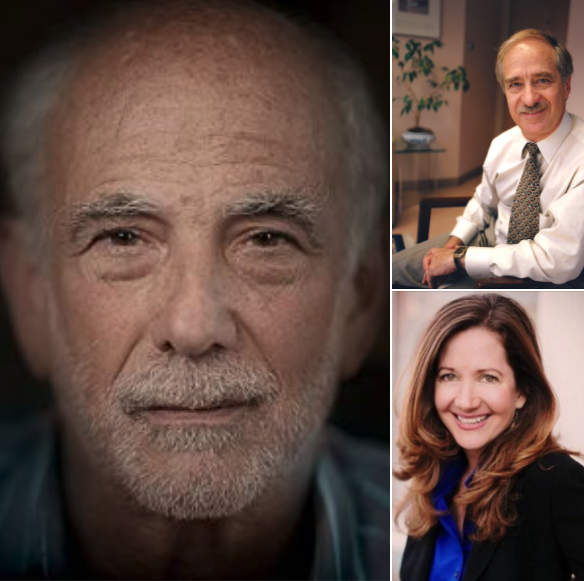

Meet my associates: Silver Divorce Consulting is an initiative I have launched with my longtime friend and colleague Barry Sacks, Ph.D. JD, a tax specialist and retirement researcher, and Mary Jo Lafaye, a reverse mortgage specialist at Mutual of Omaha. We offer an integrated approach to address the three main aspects of divorces that cause the most financial damage to couples in their 50s, 60s, and beyond. We believe that our approach can facilitate a more straightforward and less expensive path couples can follow to reach the kind of global financial settlement that divorcing couples generally need to get on with their lives.

Meet my associates: Silver Divorce Consulting is an initiative I have launched with my longtime friend and colleague Barry Sacks, Ph.D. JD, a tax specialist and retirement researcher, and Mary Jo Lafaye, a reverse mortgage specialist at Mutual of Omaha. We offer an integrated approach to address the three main aspects of divorces that cause the most financial damage to couples in their 50s, 60s, and beyond. We believe that our approach can facilitate a more straightforward and less expensive path couples can follow to reach the kind of global financial settlement that divorcing couples generally need to get on with their lives.

At Silver Divorce Consulting: Through the collaborative efforts of three national experts in their respective fields, we offer an approach that can result in an equitable division of a couple’s real estate and retirement plan assets while minimizing each spouse’s financial and tax consequences. In addition to optimizing the way marital assets are split, our approach to dividing marital assets will lead directly to a customized retirement income strategy that can provide each party with enough income to live on as they each proceed into their respective futures.

While Silver Divorce Consulting cannot promise a complete solution to all divorces, we can provide an integrated approach that will address real estate, retirement plan accounts, and taxes, which, in combination, represent the overwhelming majority of the significant financial issues a couple needs to resolve. These three issues, individually and especially in combination, are often so complex that lawyers, accountants, and financial planners struggle with understanding them and determining how to address them in a coordinated and cost-effective manner.

Coming next: We will explore the problems of Silver Divorce in greater detail through podcasts where you will hear from other experts in the field who will share their perspectives on one of the most significant hazards that can disrupt even the best of retirement income strategies.

Learn more in the Silver Divorce section of my website: peterneuwirth.com