COVID-19: Hard Lessons in Scale and Complexity

“A trillion here, a trillion there, and pretty soon you’re talking about real money.” — inspired by Everett Dirkson (1896-1969)

Little Money

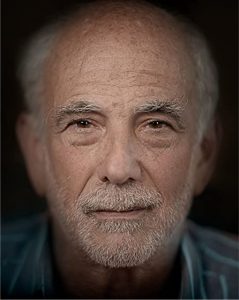

Today I enjoyed one of the few pleasures we are still allowed as I walked off of my 8.5-acre farmstead and into the high-end well-designed neighborhood of large houses, “green belts” and bike paths that has been (until the virus hit) slowly eating up back country Sonoma County. I said hello to all the dogs I passed on the road. They are the big winners in the transformation this country is going through — excited and grateful for the new attentiveness of their families and multiple extended walks that have become their routine. Unlike us, they don’t think about when it will all “go back to normal” and they certainly don’t try to figure out what happened to their world and why.

I also like to stop and chat with friendly owners who are willing to engage in what passes for neighborly socializing. I have always been curious about who actually lives in these McMansions, and when I met a 60ish woman (Debbie) and her 30 something daughter (Caroline) walking their pair of exuberant young grey Weimaraner’s, I stopped to hear their story.

While her daughter stayed quiet, Debbie, told me what it was like growing up on the (other) wrong side of Santa Rosa – an area of town I only knew from ventures to pick up day laborers to help me take care of the land that I am too old and unskilled to manage by myself. It was a story of a different time and a different place, but still one where the inter-relatedness of public welfare and economic necessity was a fact of life.

Debbie told me how, as a 14-year-old in 1970, she helped her family survive by babysitting multiple broods of younger neighborhood children as their parents hustled for work. She told me that she earned 50 cents an hour, and when the parents arrived to pick up their kids, the amount she received would be calculated to the penny with every extra ten minutes of work translating into another 8 cents.

Hearing Debbie’s story got me thinking more about money, the metric that we use to measure our economic lives and to build the bridge that translates the value of food to that of services and ultimately the Public Welfare. As the earthquake of COVID-19 has brought down businesses and rendered supply chains unreliable, so too has it made many of those equations of value unstable and as we furiously try and rebuild those bridges, we need to be cognizant of something very important.

And that is that scale matters.

Big Money

The first time, I read about something that cost more than a trillion dollars was when one of the economists advising George Bush told him that his 2003 invasion and occupation of Iraq would likely cost the country 1-2 trillion dollars before it was over. Granted it was a hypothetical number, and it was a cost to be borne over a number of years, but still it was clear that the scale of economic ventures that could be envisioned had become much bigger.

Now, a trillion dollars is a lot of money, and most people are still not used to working with numbers that big. I know I have trouble visualizing a pile of money that big. For almost every financial or policy decision made in the decade since the Iraq War and occupation ended, costs and benefits were measured in millions and sometimes billions, but with COVID-19 we have entered a new era where we have added additional zeros to the money we are spending. In short, the scale of both our problems and the cost of solving them has increased by orders of magnitude.

These days when economists discuss what we or the government must do they talk about sums of several trillion, even tens of trillions. From an economic perspective, these discussions are fundamentally different than those of decades past because when money that big is involved, you can’t move it around without affecting the environment in which you are transacting. It is like trying to solve the “three body problem” in astronomy where the Money, the Economy and the Public’s wellbeing are the three planets whose paths you are trying to plot. Only it is worse than trying to calculate the effects of gravity because it is not pure physics or math we are dealing with, but rather human psychology and behavior that drive the impact of one on the other.

That doesn’t mean we shouldn’t keep trying to find a solution to our overwhelming economic and public health problems. It just means that it is much more complicated

I recently had the opportunity to participate in a Zoom “cocktail party” with some of the smartest people I know. “Coronavirus economics” was the subject and the issue of what to do about the trade-off between economic hardship and minimizing COVID-19 deaths was front and center. The conversation was hosted by Jon Haveman who serves as executive director of the National Economic Education Delegation (“NEED”). I was among a number of Berrett Koehler authors who were invited to listen to what Jon had to say and to share our reactions.

NEED’s members include over 500 professional economists (mostly Ph.D’s) and is supported by an honorary Board of the biggest names in the field of economics (e.g. Janet Yellin, Ben Bernanke, Alan Binder and many others). I am pretty careful about who I pay attention to, but as far as I can see, these guys know what they are talking about, they have not been politicized, and it is a place I wouldn’t hesitate to go to for information. They take on big economy-related problems. Their mission is to try to figure things out using an economic theoretical lens to look at the issue, and then communicate their insights to the world at large.

For those interested you can watch the entire video of our session here. At a minimum, you should watch the beginning to get a sense of how credible and serious Jon is about the importance and validity of his analysis.

I think Jon and his colleagues are performing a valuable and heroic service trying to figure out what is happening to us right now as the Public Health crisis is performing a dangerous dance with the Economy — one affecting the other significantly and unpredictably — dampening and amplifying impacts in mysterious ways and at even more mysterious intervals and amplitudes.

As I digested the contents of the conversation between the BK authors and Jon, my first instinct was to think that what Jon is trying to do is impossible. My mathematician father put it best when he likened the conversation in the video to a bunch of physicists sitting around a room trying to figure out the likely future evolution of the Cosmos. That may be, but I believe what Jon and his colleagues at NEED can do is to help us figure out the next correct step, or at least be able to evaluate the next steps we can imagine.

That might seem funny coming from someone who rants at length about the unpredictability of the future, because it is largely driven by Chaos and/or Black Swans emerging from “fat tailed” probability distributions. COVID-19 appears to many of us to be a black swan event and the times feel distinctly Chaotic. With human behavior as one of the hidden algorithms fueling the engine driving this crisis it is hard to see how it wouldn’t be chaotic.

But Chaotic processes, like the weather, are actually variably unpredictable. What I mean is that such processes are always unpredictable, but they are very close to predictable in the short term, while being very unpredictable over long time horizons.

That is a very hopeful thing, and it means that if we can understand where we are, which direction we are headed in and how fast we are going, then NEED and the rest of our collective brains might be able to figure out where we will end up if we don’t stray from our current path.

The real problem is that it looks bad in all direction and wherever we are going we seem to be getting there faster and faster every day. What Jon and others have already figured out is that because we are moving faster and faster, we have more momentum, and because we have more momentum it takes more energy (financial, material, political) to change our direction. Jon’s view is that even though we won’t know the long-term consequences of actions we take now (e.g. creating $5 trillion of new money to avert an economic depression) we can evaluate the short-term impact of that versus other steps we might take.

I agree, but there are other issues that arise when we start taking steps of this magnitude.

COVID-19 and scaling up

Society has gotten used to framing and addressing our problems with the common metric of dollars. This isn’t a bad thing necessarily as problems are difficult to formulate precisely without some well-defined metric that can be used to measure things and organize data. “Dollars” is actually a pretty good one because most things can be measured in dollars. In fact, that was the point of inventing money in the first place – to create a medium of exchange which allows one to compare the value of goods, services and other quantities to each other.

That being said, measuring things in dollars is potentially problematic for two reasons:

- Some critical quantities/variables can’t easily be measured in dollars (e.g, “individual freedom”, or even the value of a human life as Jon suggests is necessary in the video)

- The dollar amounts we are dealing with have gotten so big as to distort and potentially destroy the validity of the measure itself. In other words, Dollars have already become so divorced from any concrete reference point (e.g. gold), that it seems illogical to think that the Fed can continue to dramatically increase the supply of money ad infinitum without at some point undermining the notion of money itself.

But our problems go even deeper. Assuming you can frame both the problem and the policy solutions in terms of actions with “dollar costs” and “dollar benefits”, I think we are facing more psychological/cognitive issues with trying to understand and manage what is going on.

In particular, the vastly increased scale of the system that we are trying to manage and the forces we are using to affect it are beyond anything we have ever attempted as a species — certainly on a coordinated basis. And that is central to the problem. Even if it can be attacked on a local or national level, in some sense COVID-19 is a global Public health problem, and it is now apparent (much more than 100 years ago when the Spanish Flu pandemic occurred), that ensuring the common welfare of people has become a much more complex and global problem than it used to be. On the economic side, we learned just how complex and fragile the Global Financial System is when it suffered an earthquake of a comparable (but in my opinion lesser) magnitude in 2008. It is not at all clear whether the global economy is more or less fragile and prone to collapse than it was a decade ago. However, it is certainly more complex, buildings are still crumbling and the after-shocks keep coming.

Worse than that, not only was COVID-19 part of what caused the earthquake in the economy, but there is an inter-relatedness between the health system and the financial system that seems to amplify the quaking. It seems that the Public Health crisis (and our attempts to manage it) is exacerbating the Economic crisis, and it won’t be too long before the reverse is manifestly true.

We know a little more than we did back in 2008, but I’m not sure we’ve learned enough about the impact of all the different kind of shocks that we are applying to a complex interconnected system like that of money, and I know that we don’t know what the impact of printing $10 trillion will be. We don’t think that creating so much money can do any harm to public health, but we still don’t know what the public health implications are of what we have already done to the economy let alone what the long term consequences on inflation/deflation/price stability of the Fed’s actions will be.

Maybe it will be ok, but maybe it won’t. As a Chemistry professor friend once told me as we were talking about the multitude of decisions we had to make each day managing our 9 year old sons:

“We will know soon enough what the correct answers were since right now we are doing the experiment.”

Let’s hope we too are making good choices as individuals and as a society and don’t end up blowing up the Lab as we keep inventing one treatment after another to contain a worldwide health/economic crisis that just seems to cause more suffering every day.