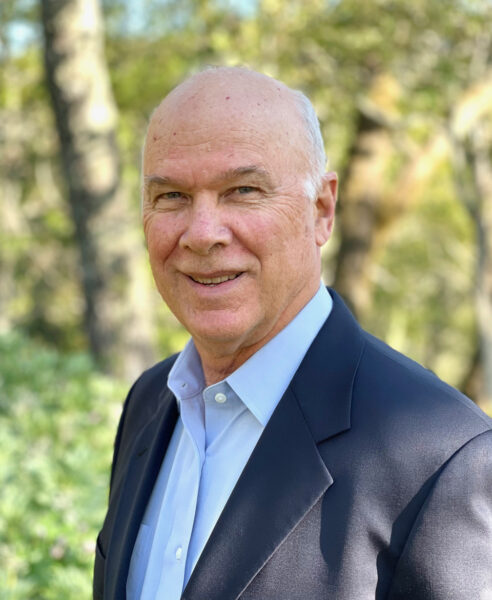

Ep5: Retirement Income Strategies — Meet Steve Vernon, F.S.A., president of Rest-of-Life Communications

A Note from Peter Neuwirth — I invite you to tune in for this week’s episode of my podcast and video show, Money Mountaineering, where for 30 minutes, financial experts help us answer the question: What’s your future worth?

Meet our guest: Steve Vernon, F.S.A., president of Rest-of-Life Communications

Pete asks:

- Exactly what is longevity risk, and how can people prepare themselves for a long retirement?

- In managing their assets, how can retirees protect themselves against the possibility of diminished capacity due to aging?

- How can financial advisors and institutions help both retirees and pre-retirees address both of these risks?

- At what age do you recommend a retiree decide to begin receiving their Social Security benefits?

About our Guest: ”For this next phase of my life, I want to help people make important retirement planning decisions, so they can live long and prosper,” says Steve Vernon, F.S.A., president of Rest-of-Life Communications, where he speaks, writes, and conducts research on the most challenging aspects of retirement, including finances, health, and lifestyle. He previously served for nine years as a consulting research scholar at the Stanford Center on Longevity. He retired as a Vice President of Watson Wyatt Worldwide after a 30+ year career helping Fortune 1000 employers design, manage and communicate their retirement programs.

Steve has written more than 1,000 online columns on retirement and longevity topics for CBS MoneyWatch and Forbes.com over a 12 year-year period. His latest book, released in July 2020, is Don’t Go Broke in Retirement: A Simple Plan to Build Lifetime Retirement Income. His previously published works include:

- Retirement Game-Changers: Strategies for a Healthy, Financially Secure, and Fulfilling Long Life

- Money for Life: Turn Your IRA and 401(k) Into a Lifetime Retirement Paycheck

- Recession-Proof Your Retirement Years: Simple Retirement Planning Strategies That Work Through Thick or Thin

- The Quest: For Long Life, Health and Prosperity (a DVD/workbook package)

- Live Long & Prosper! Invest in Your Happiness, Health and Wealth for Retirement and Beyond

- Don’t Work Forever! Simple Steps Baby Boomers Must Take to Ever Retire

Steve also authored or co-authored 19 research reports and articles on retirement income strategies, retirement decision-making, and longevity topics while he was at the Stanford Center on Longevity. He is quoted frequently in such publications as The Wall Street Journal, New York Times, Los Angeles Times, USAToday, Washington Post, BusinessWeek, Fortune Magazine, CNBC, Forbes, Kiplinger’s, and Money Magazine. He is an experienced speaker, with over 300 presentations, keynote addresses and workshops on his various works. He also volunteers for various research committees for the Society of Actuaries and the Institutional Retirement Income Council.

He is a Fellow in the Society of Actuaries and a Member of the American Academy of Actuaries. He graduated Summa Cum Laude from the University of California, Irvine, with a double major in mathematics and social science. Steve and his wife Melinda split their time between Ventura County, California and the Bay Area. Click here to learn more: restoflife.com

And, click here to learn more about actuary and author Peter Neuwirth: www.PeterNeuwirth.com

- Listen to our podcasts on PeterNeuwirthRadio.com

- Watch all of our episodes: www.PeterNeuwirth.tv