November 2023: This month host Peter Neuwirth tells guest Richard Conn Jr., "I love your idea that reality is the road to happiness. It's consistent with what we do in actuarial science — substitute facts for appearances and demonstrations for impressions."

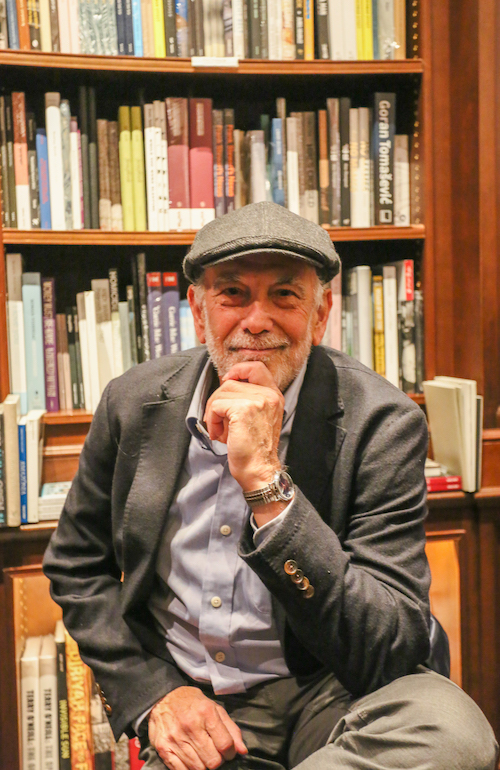

Ep3: The Sharing Economy — Meet critical thinking expert Richard Conn, Jr., author of “The Earthbound Parent”

A Note from Actuary and Author Peter Neuwirth, FSA, FCA, host, The Sharing Economy” — I invite you to tune in for this week’s episode of my podcast and video show, Money Mountaineering, where for 30 minutes, financial experts help us answer the question: What’s your future worth? In the fall of 2023, we launched Season 2, where we focus on the power of the Sharing Economy.

Meet the month’s guest: Critical thinking expert Richard Conn, Jr., author of “The Earthbound Parent”

Our topic: Reality is the Road to Happiness

Pete asks Richard:

- I love your idea that “reality is the road to happiness,” which is entirely consistent with what I have been saying about the mission of actuarial science — to “substitute facts for appearances and demonstrations for impressions.” From what I know about you and your background, you have spent much of your career combatting basic human fears and desires that hinder our ability to think critically. What are the main emotional/instinctual aspects of the human experience that impede our ability to think critically?

- As an international attorney, you have much experience working in Russia to implement a market-based economic system. What challenges did you face?

- I assume external factors (e.g. the absence of the rule of law) and internal factors like people’s fears and desires were challenges to achieving success. What did you learn in Russia that is applicable here in the United States, where the rule of law seems to hold, but people’s fears and desires seem to interfere with their ability to think critically?

- As a fellow chess aficionado, I can’t resist asking you about your experiences advising those at the top of the international chess world — especially since we both agree that chess is an ideal model for mastering critical thinking. Tell us about your experiences.

- Along the same line, there is the tendency for many people to fall prey to magical thinking and/or let their fears and desires govern the moves they make. Can you share your insights in both these areas and tell us how individuals can navigate economically through turbulent and challenging times — especially in an era when financial markets have become unpredictable, and the value of money itself has become uncertain?

- In this podcast, I have suggested that the “sharing economy” is one path. But there are many other aspects to the problem, and I believe it all starts with a clear-eyed and critical assessment of one’s situation. So let’s turn to the concepts outlined in your book, The Earthbound Parent, and talk about the notion of early interventions. What can we do to equip the next generation with the ability to think critically and help them surmount economic and other challenges that our generation has saddled them with?

About our guest: Richard Conn Jr. is the Managing Partner of Eurasia Advisors, which he founded in 2003. He has practiced international corporate law for over two decades as an equity partner with Latham & Watkins. He founded the firm’s Moscow office in 1992. He served as a key advisor to the Presidential Administration of Russian President Boris Yeltsin and as President of the Moscow-based Foreign Bar Association. A longstanding past member of the Board of Directors of the U.S.-Russia Business Council and of the International Crisis Group’s International Board of Advisors, he regularly consults with the World Bank, Members of Congress, and the Administration regarding C.I.S.-related issues. He co-chaired the U.S.-Russia Business Council and American Chamber of Commerce (Moscow) joint initiative to facilitate Russian accession to WTO.

About our guest: Richard Conn Jr. is the Managing Partner of Eurasia Advisors, which he founded in 2003. He has practiced international corporate law for over two decades as an equity partner with Latham & Watkins. He founded the firm’s Moscow office in 1992. He served as a key advisor to the Presidential Administration of Russian President Boris Yeltsin and as President of the Moscow-based Foreign Bar Association. A longstanding past member of the Board of Directors of the U.S.-Russia Business Council and of the International Crisis Group’s International Board of Advisors, he regularly consults with the World Bank, Members of Congress, and the Administration regarding C.I.S.-related issues. He co-chaired the U.S.-Russia Business Council and American Chamber of Commerce (Moscow) joint initiative to facilitate Russian accession to WTO.

Richard delivered the keynote address at the United Nations to open the U.N. conference addressing establishing a worldwide Sovereign Debt Restructuring framework. He frequently publishes on these subjects and recently authored “Towards a Sovereign Debt Restructuring Framework: Less is More,” which appears in Joe Stiglitz’s book Too Little, Too Late: The Quest of Resolving Sovereign Debt Crises, Columbia University Press, New York, 2016.

Richard ran in 2010 for the Deputy Presidency of the World Chess Federation on an international ticket headed by the Twelfth World Champion Anatoly Karpov with the support of the Thirteenth World Champion Garry Kasparov and is an avid chess player. He сhairs the Advisory Committee of a non-profit organization that has already taught chess to over 4 million public school second and third graders in the U.S.

He is a Dartmouth College and Fordham University Law School graduate and clerked for the Honorable Gordon Thompson, Jr., Chief Judge of the U.S. District Court, Southern District of California. He also is the co-author of Collier Labor Law and the Bankruptcy Code, M. Bender (1989).

Most recently, Richard wrote The Earthbound Parent: How (and Why) to Raise Your Little Angels Without Religion, Pitchstone Publishing (2018), a book encouraging critical thinking and enhanced ethical standards. Richard is fluent in Russian and Spanish. Click here to learn more: eurasiadvisors.com.

Author and Actuary Peter Neuwirth, FSA, FCA, host, “Money Mountaineering: The Sharing Economy”

About Peter Neuwirth, FSA, FCA: Pete is an actuary specializing in retirement plan issues. He is a 1979 graduate of Harvard College with a BA in Mathematics and Linguistics. After leaving Harvard, he went to work at Connecticut General Life Insurance, now CIGNA, and for the next 38 years, he worked continuously as an actuary holding significant leadership positions at a variety of firms around the country, including most of the major consulting firms (Aon, Hewitt Associates, Watson Wyatt, Towers Perrin and finally Towers Watson). He spent 5 years as a chief actuary at a regional benefits consulting firm (Godwins), 7 years running a small actuarial firm (Coates Kenney), and one year in a large accounting firm (Price Waterhouse). At the end of 2016, he retired from Towers Watson to focus on writing and researching financial wellness issues.

Pete continues researching various financial wellness issues, including using home equity to generate retirement income. In 2018 he taught a graduate seminar on this subject for the actuarial science department at the University of California at Santa Barbara. He is currently associated with the Academy for Home Equity in Financial Planning at the University of Illinois.

In addition to his books “Money Mountaineering” and “What’s Your Future Worth?”, his research has been published in professional journals, including the Journal of Deferred Compensation, Contingencies, and Journal of Financial Planning. His articles have also been published in numerous online actuarial web publications. He is a frequent speaker at professional conferences such as the Conference of Consulting Actuaries, Enrolled Actuaries, and Western Pension and Benefits Conference. He is a Fellow of the Society of Actuaries and the Conference of Consulting Actuaries.

Click here to learn more about actuary and author Peter Neuwirth: www.PeterNeuwirth.com • Listen to our podcasts on PeterNeuwirthRadio.com • Watch all of our episodes: www.PeterNeuwirth.tv