The Actuarial Approach and Recommended Financial Planning Process for Retirees and Near Retirees: Ken Steiner’s 7 Principles to Accomplish Your Financial Goals

A Note from Peter Neuwirth: It is a pleasure to feature actuary Ken Steiner in the June episode of Money Mountaineering. As mentioned in our interview, Ken has created a list of 7 actuarial principles to help accomplish financial goals. He calls it the “Actuarial Approach” and has been kind enough to share those with us in the essay below. Thank you, Ken! We know our audience will benefit from this insight. Scroll down to read all about it!

How Much Can I Afford to Spend in Retirement? An essay by actuary Ken Steiner

Principle # 1 – Comparison of Assets and Spending Liabilities

The Actuarial Approach can be used by retirees and pre-retirees to:

- determine the assets needed to support aspirational spending liabilities (desired spending)

- develop a spending budget based on existing assets

- help make other personal financial decisions

To use it effectively, first, determine your financial goals and make assumptions about the future.

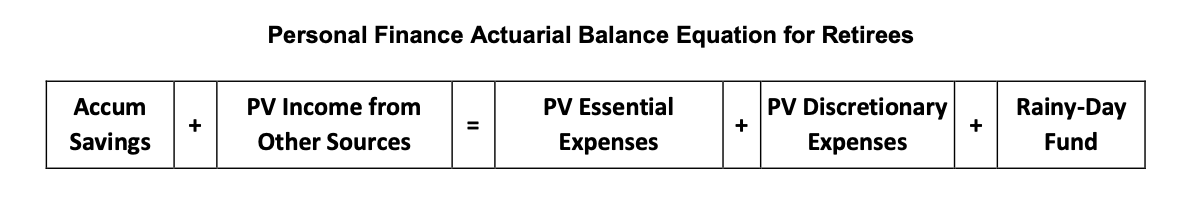

1. Determining the assets needed to provide aspirational liabilities (desired spending): Target assets are determined by solving the actuarial balance equation below for the assets necessary to support the present value of desired spending.

Left side of equation: Your assets.

Left side of equation: Your assets.

Right side of equation: Your spending liabilities. Spending liabilities can be further segmented into other categories, such as recurring expenses, non-recurring expenses, amounts to be left to heirs, etc.

PV is an abbreviation for present value. While calculation of present values may seem intimidating, it is a necessary process to accurately capture the value of future retirement income and expenses (which are frequently uneven, or non-linear, from year to year).

Our Excel workbooks are designed to help you with these present value calculations. We include “default” assumptions based on assumptions we believe to be reasonable, but these default assumptions can be overridden if you do desire.

* These three basic actuarial principles are the same principles used by pension actuaries to help pension plan sponsors manage pension plan contributions (including the use of deterministic assumptions about the future).

2. Developing an annual spending budget based on the assets you have: An actuarially determined spending budget for the year is developed by solving the actuarial balance equation above for the present value of future spending that equals the present value of your assets. The resulting budget is then used as one of possibly several “data points” to help you develop your actual spending budget for the year.

3. Making other personal financial decisions: Applying the actuarial balance equation above can help you (or you and your spouse) make other personal financial decisions, including:

- timing of retirement

- how much you should be saving

- timing of Social Security benefit commencement

- investment strategies to cover expected essential and discretionary expenses

- whether to take benefits from a defined benefit pension plan in the form of a lump sum or annuity

- when to reduce or increase spending

- whether to purchase an annuity product

- whether to take a part-time job in retirement

- and many other financial decisions

Principle # 2 – Annual Actuarial Valuations

To keep spending on track to meet financial goals, the actuarial spending budget calculation should be performed periodically (we recommend annually). The actuarial approach is a dynamic self-adjusting process. Factors such as actual spending, changes in economic conditions, personal situation, financial goals, etc. should be monitored and appropriate changes made in future annual actuarial valuations. Our workbooks and blogposts include a smoothing algorithm that may be used to smooth changes in the annually calculated spending budget.

Principle # 3 – Modeling Deviations in Assumed Experience to Potentially Mitigate Financial Risks

Periodically stress-testing significant assumptions so that you can consider strategies to mitigate risks associated with making incorrect assumptions about the future. Our workbooks for Single Retirees and Pre-Retirees include a 5-year Projection tab to model deviations in investment returns and actual spending. For more information on modeling deviations in assumed experience, see our post of November 26, 2017.

Recommended Financial Planning Process for Retirees and Near Retirees

Step 1: Determine your retirement assets and other sources of retirement income.

Step 2: Estimate your desired or preliminary budget annual recurring expenses including taxes, and your desired or preliminary budget non-recurring expenses. This step may involve selecting rates of future expected increases in such expenses (which may differ depending on expense type).

Step 3: Categorize each expense in Step 2 as essential or discretionary (% Essential) and each asset source in Step 1 as risky or non-risky (% Upside)

Step 4: Using one of our Actuarial Financial Planner workbooks for retirees, determine the present values of

- your Floor Portfolio (non-risky)

- your Upside Portfolio (risky) assets

- your essential expenses and

- your discretionary expenses

- by completing the input section of the workbook.

The above present values are found in the Actuarial Balance Sheet section of the workbook. Note that more aggressive assumptions may be used in determining the present values of Floor Portfolio assets and discretionary expenses.

Step 5: Compare the total present value of your assets with total present value of your preliminary budget spending liabilities. This comparison is summarized in the Actuarial Balance Sheet as your “Rainy-Day Fund.”

If your Rainy-Day Fund is negative, consider the following actions, including:

- increasing your assets (for example through part-time employment or including previously ignored assets in the calculation)

- decreasing your current and/or future spending budgets. Generally, budgeted discretionary expenses will be reduced first

- modifying the default assumptions or data used in the calculations, if appropriate

- applying reasonable smoothing to your current spending budget

- or some combination of these alternatives

If your Rainy-Day Fund is positive, consider the following actions, including:

- increasing your current and future spending budgets

- increasing or maintaining your Rainy-Day Fund

- or increasing some combination of the two

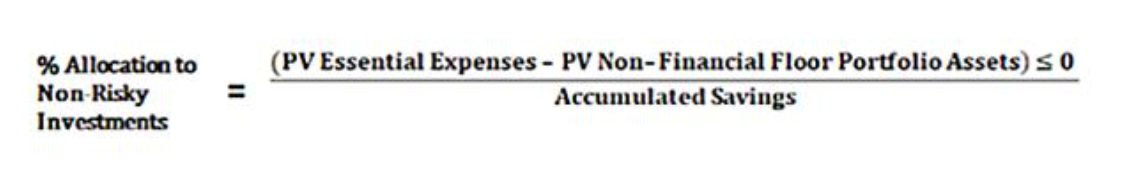

Step 6: Develop a Liability Driven Investment (LDI) strategy consistent with floor and upside portfolio calculations in Step 4, where investments in low-risk assets are anticipated to be sufficient to fund spending on future essential expenses and investments in risky assets are anticipated to fund spending on future discretionary expenses. Alternatively, you can reclassify your expenses between those that you consider to be essential and those that you consider to be discretionary.

The following equation may be used to determine how much of your accumulated savings should be allocated to non-risky investments under this approach.

Step 7: Repeat above steps at least once a year to keep your spending budget and investment strategy on track, and periodically model deviations from assumed experience by stress testing significant assumptions for the purpose of modifying your plan to mitigate risks.

Step 7: Repeat above steps at least once a year to keep your spending budget and investment strategy on track, and periodically model deviations from assumed experience by stress testing significant assumptions for the purpose of modifying your plan to mitigate risks.

© Copyright 2022 howmuchcaniaffordtospendinretirement.blogspot.com