Retirement Planning: Generating Lifetime Income, Leaving a Legacy, and the Components of Net Worth Throughout Retirement, Published by the Conference of Consulting Actuaries

August 2022: A Note from Peter Neuwirth — The Conference of Consulting Actuaries published this research paper this month, and my co-authors and I are thrilled. The mention of the paper is featured in a video by CCA President Ellen Kleinstuber (pictured right). Please click here to read the executive summary, find details about my collaborators Stephen and Barry Sacks, and also read the introduction to our work. We also invite you to link to read the entire paper, where it is published on the CCA website.

Executive Summary

- A number of articles have appeared on the sustainability of inflation-adjusted (constant purchasing power) cash flow during retirement. Various strategies using home equity in conjunction with retirees’ securities portfolios have been analyzed and compared using Monte Carlo simulation.

- These articles demonstrated that, in general, cash flow sustainability is greatly enhanced by using home equity, as compared with not using home equity.

- These articles demonstrated that some strategies for using home equity, in some circumstances, provide greater enhancement of sustainability than other strategies. • More specifically, when home equity, accessed by a reverse mortgage credit line, is used in the “Coordinated Strategy,” and the home value is at least as great as the portfolio value, the probability of sustained cash flow throughout a 30-year retirement is greater than when the “Last Resort Strategy” is used. By contrast, when the portfolio value is greater than the home value, the two strategies provide approximately equal probabilities of cash flow sustainability.

- The previous articles have not considered, in any detail, the legacies left by the retirees nor compared them using the two strategies. This article fills that gap and provides an analysis and comparison. The results show the medians and 10th percentiles of the legacies for each of the three representative retirees using the two strategies.

The previous articles have not considered the composition of the retirees’ net worth during retirement, using each of the two strategies. This article fills that gap and quantifies the extent to which the Coordinated Strategy results in greater proportions of securities in the retirees’ net worth than the Last Resort Strategy. Greater proportions of securities, in turn, provide greater flexibility for the retiree and his/her financial planner to adjust to future changes in economic conditions.

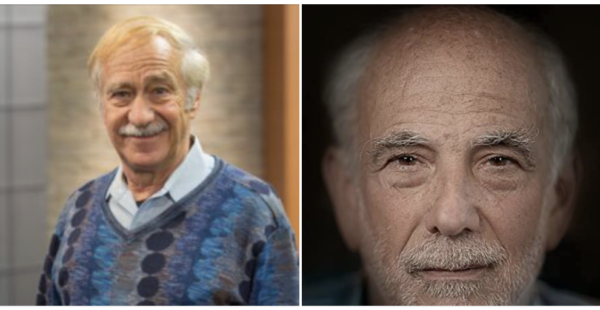

Barry Sacks (left) and Peter Neuwirth (right)

Research and Published Paper by:

Peter Neuwirth, FSA, FCA (pictured right), is an actuary with 43 years of experience in retirement and deferred compensation plans. Recently retired from Willis Towers Watson in San Francisco, he now maintains an independent actuarial consulting practice. He has published numerous articles on deferred compensation, a book on balancing time, risk, and money, and a more recent book on financial planning. Contact: peteneuwirth@gmail.com

Stephen R. Sacks, Ph.D., is a professor emeritus of economics at the University of Connecticut. He maintains an economics consulting practice in New York and has published several articles on operations research and on retirement income planning. Contact: SSacks456@gmail.com

Barry H. Sacks, J.D., Ph.D., (pictured below) is a practicing tax attorney in San Francisco. He has specialized in pension-related legal matters since 1973 and has published numerous articles on retirement income planning and on tax-related topics. Contact: barrys88@yahoo.com

Introduction

Introduction

A number of articles have appeared in this Journal focused on the sustainability of retirees’ cash flow throughout retirement. (see, e.g., Sacks and Sacks 2012; Salter, Evensky, and Pfeiffer 2012; Wagner 2016; Pfau 2016; Neuwirth, Sacks, and Sacks 2017; Walker, Sacks, and Sacks 2021). These articles have focused on retirees whose primary source of income is a securities portfolio (typically, but not necessarily, held in a 401(k) account or a rollover IRA). They have demonstrated that it is possible to enhance the sustainability of cash flow in amounts greater than allowed by the classic “4 percent rule.” This is accomplished by using a “buffer asset” (specifically, home equity accessed by means of a reverse mortgage credit line), in a strategy coordinated with the portfolio in a way that offsets the portfolio’s volatility.

Those articles are based on the Monte Carlo simulation of the investment performance of securities portfolios and of inflation and on the assumption of annual distributions that are inflation-adjusted to have constant purchasing power. Although in several of those articles, there has been some mention of the retirees’ residual net worth or their legacy, none has focused specifically on and explored in depth the measure of residual net worth or legacy of the retirees considered. Moreover, those articles did not examine the individual components that constitute the retirees’ legacy or net worth and the relative proportions of those components.

This article is in three sections: The first section provides a background, summarizing the results of the earlier work on which the second and third sections are based. The earlier work posited three representative retirees, all having the same initial net worth but with different initial values of the components of that initial net worth. The results of the earlier work focused on the retirees’ cash flow survival throughout a 30-year retirement. The second section of this article sets out the results of computations of the values of the representative retirees’ legacies (which would be their net worth amounts) at a range of time points throughout a 30- year retirement. The third section of this article examines the values of the components of the representative retirees’ net worth at the same time points during the 30-year retirement. (The components are the securities portfolio and the home equity.) In this article, as in the previous work, the total value of these assets is expressed by the terms “legacy” and “net worth.” The reason for using two different terms is explained below.

Background

This article continues and draws on the previous work (Sacks and Sacks 2012; Neuwirth, Sacks, and Sacks 2017; Walker, Sacks, and Sacks 2021) in the following ways:

- As in the previous work, the retirees are assumed to have, as their primary assets available to provide retirement income, a portfolio of securities (typically, but not necessarily, in a 401(k) account or a rollover IRA) and home equity (accessed by a reverse mortgage credit line). In this article, as in the previous work, the total value of these assets is used synonymously with the term “net worth.”

- As in the previous work, two strategies for taking distributions from the assets are compared: One strategy called the “Coordinated Strategy,” involves the retiree’s establishing the reverse mortgage credit line immediately upon retirement and taking distributions from the credit line each year immediately following a year in which the portfolio’s investment performance is negative or weak. The other strategy, called the “Last Resort Strategy,” involves the retiree taking distributions only from the securities portfolio until the portfolio is exhausted, and then (if the portfolio is exhausted) establishing the reverse mortgage credit line and taking all subsequent distributions from that credit line.